Guide to the General Election 2024: Tax implications for your business

As a business owner, you’ll likely be wondering how the upcoming general election on 4 July 2024 is likely to affect your business. A new government can mean significant legislative changes and tax upheavals that can impact your business operations and financial planning.

The parties have issued their manifestos, so let’s break down what they’ve said about tax.

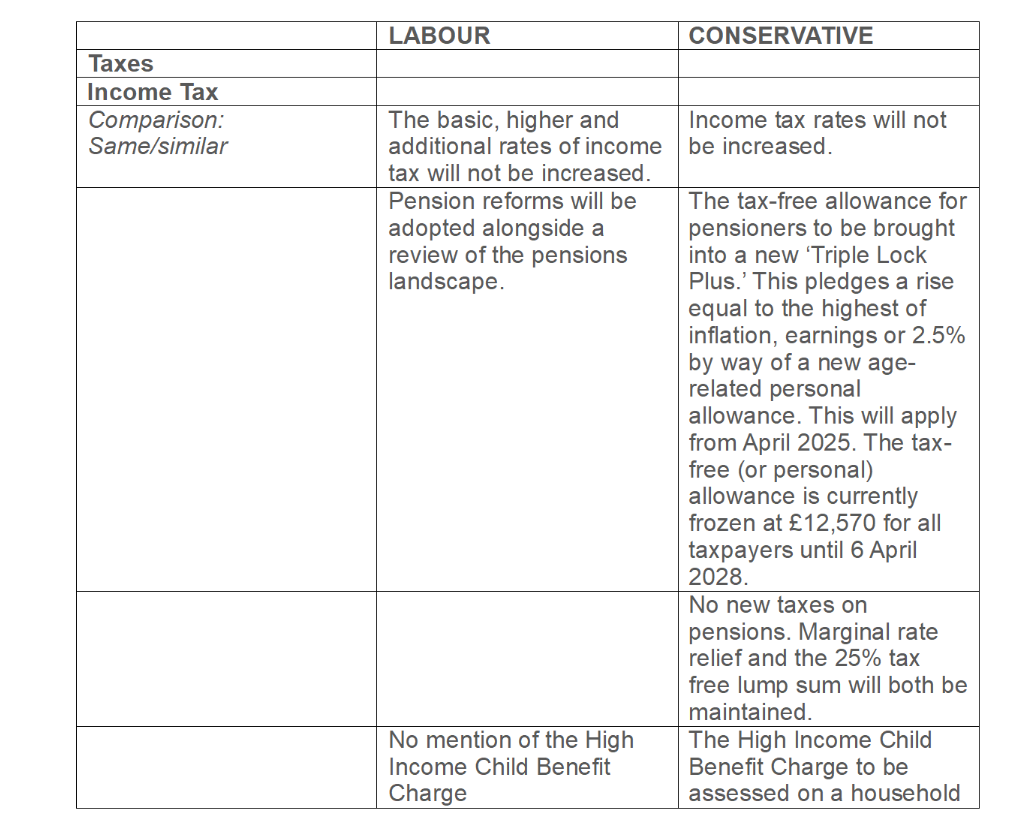

What Labour and the Conservatives have said about tax

Here is a comparison table of what Labour and the Conservatives say in their manifestos about tax.

What the other parties have said about tax

The Liberal Democrats, under their manifesto "For a Fair Deal," are proposing a fairer tax system. They're looking at:

increasing the global minimum corporation tax rate to 21%. This looks like an increase to the current UK small profits rate of 19%.

raising the personal income tax allowance when public finances allow.

The Green Party's "Real Hope. Real Change" manifesto is quite ambitious. They’re advocating for:

·a £15 per hour National Minimum Wage but allowing small businesses to reduce their National Insurance payments as an offset.

a wealth tax for those with assets above £10 million.

aligning Capital Gains Tax (CGT) rates with income tax rates.

aligning the tax rates on investment income with the combined income and NIC rates paid on employment income.

removing the NIC upper earnings limit, which will mean higher earning employees paying NICs on all their employment earnings at the main rates.

Reform UK, with their "Britain Needs Reform" manifesto, includes proposals like:

increasing the personal allowance to £20,000 and the higher rate threshold to £70,000.

cutting residential Stamp Duty Land Tax (SDLT) to 0% for properties below £750,000 and 2% for properties costing £750,000 - £1.5m.

re-establishing the VAT refund scheme for tourist shopping.

abolishing Inheritance Tax (IHT) for estates under £2 million and bringing the rate for estates worth more than that down to 20%.

lifting the small profits threshold for corporation tax to £100,000.

lowering the main rate of corporation tax from 25% to 15% over three years.

abolishing IR35 rules.

increasing the VAT registration threshold to £150,000.

no VAT and a 20% income tax relief on school fees

reducing UK tax legislation from 21,000 pages to nearer 500.

Plaid Cymru, in their “For Fairness, For Ambition, For Wales” manifesto:

Believe that Wales should have full control of economic levers and want the Senedd to have powers to set income tax bands and thresholds, as is the case in Scotland.

Pledge to campaign for capital gains tax to be equalised with income tax.

Pledges to investigate increasing NICs, introduce a wealth tax, further crack down on evasion and avoidance and to abolish loopholes for non-domiciled individuals.

The SNP’s manifesto, “A future made in Scotland” includes:

The demand for the full devolution of tax powers, including over National Insurance, windfall taxation for companies and to crack down on tax avoidance and evasion.

Support for the reform of VAT to address imbalances in the rating system, including ending the VAT exemption for private schools.

A pledge to introduce a lower VAT rate for hospitality and tourism sectors.

Can you rely on these manifesto pledges?

A government is not legally held to its manifesto or required to stick to the promises they have made. Circumstances change and even a fully intentioned promise made now may or may not be suitable in 2029. So, while it’s reasonable to think that at least some pledges will turn into reality, there is no guarantee.

Whether or not these pledges are actually affordable when it comes down to it is of course another question.

Will we have another budget?

If a new party comes into power on 4 July, then they will likely set out their initial plans in an ‘emergency’ budget. Since the Office of Budget Responsibility (OBR) will need 10 weeks to prepare independent forecasts, this is unlikely to happen until September or October.

Regardless of the election outcome, we are here to support you through any changes. Following the election and the announcement of any budget, we’ll let you know and we’ll be happy to provide you with personalised advice if you want it.

Please feel free to reach out to discuss any concerns or to schedule a consultation. Together, we can navigate these changes!